Knowing the difference between good debt vs bad debt, could make you rich. Good debt makes you money. Bad debt costs you money.

Dave Ramsey would have you think that ALL debt is bad debt. Well, that’s because Dave Ramsey has a niche that covers the masses and his simple message will fall on the ears of those struggling from our society’s debt syndrome. In other words, he makes more money with a simple message that relates to more people.

I am not bashing Dave for his efforts. It’s just an incomplete message. It’s a message and a plan for people to get to ZERO. But that only gets you to even. Being at zero might be better than where you are, but it’s not a path that leads to your dream life. There’s No wealth building plan. There is no plan to show you how your good debt will pay for your bad debt.

Good Debt Makes You Money

Full disclosure: You’re not going to read one article and get ultra-rich this month. This is about changing the way you think about money and debt, so you can make and keep more money.

You can learn to do what the rich do with debt? If the rich have bad debt (say a super car for example), they have good debt that produces more than enough income to pay for that bad debt. However, the good debt is already in place to pay for when the acquire bad debt. If this sounds goofy to you right now, don’t stop reading.

If you’re only interested in getting to out of debt and don’t care about living without fear of “no money”, then click here and at least let Dave Ramsey get you to zero.

Just A Warning

While I feel for those people who have acquired a lot of bad debt, I feel it’s important to be blunt with the truth. So if you’re in up to your neck, this website will certainly provide a shift in the way you see money, debt, employment, taxation, and opportunity. Dig in and look around. With a changed perspective on the cause of one’s financial problems, opportunities start to appear, that you couldn’t see before. Just be prepared to hear the truth.

For Example

Growing up, I always understood that you shouldn’t make any purchases unless you have the money to pay for them. The only exception to this was your home. Well, when I heard the concept of good debt vs bad debt in a book I read, I was hearing a new message and it opened my eyes.

“Bad debt cost you money, but Good debt makes you money”

Now I had been investing in real estate for a couple years before I heard this. I used a home equity line of credit to buy my first two investment houses, so I was doing the right thing with debt. Otherwise I stayed completely debt free, because of what I was taught as a kid.

After hearing that message about good debt, I was now able to hear many other (normally) hidden messages about investing and money. Now I could see the potential growth opportunities using good debt. I will tell you there’s a snowball effect that goes on. With every new message I’m able to hear, I can then hear more messages.

For me, because I was taught to be debt free as a kid, you could say I operated somewhere in the middle of “good debt vs bad debt”. But after hearing that message, I could at least see what I was doing and then be able to see opportunities from the possibility of using debt as leverage. But I will tell you, it’s not easy breaking a habit. I still pay cash when flipping a property.

Examples

Good debt is fairly easy to get. Why? Because it needs to happen! Bad debt is a little more difficult to get, because you personally need to earn enough to pay it back. So let me give you an example of bad debt first.

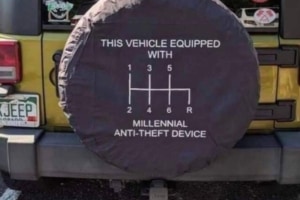

- Buying that new car with financing is bad debt.

OK, now a couple examples of good debt.

- Buying a new car with financing that is being used as a taxi, Uber, or Lyft. If the car produces more income each month than it is costing you, it’s good debt.

- Buying a rental house with a tenant in place that produces more income from rents than it costs in expenses, leaving you with positive cashflow (extra money) is good debt.

So, how would the rich use this scenario? The rental house would produce enough net cashflow (the amount of money left after paying all expenses) each month to pay the debt service (car payment) on the new car.

The good debt overwhelms the bad debt so there’s always more money coming into the household than going out. They also don’t ever acquire bad debt without already having good debt in place with more than enough positive cashflow to pay for the future bad debt.

The rich focus on assets vs liabilities, and that’s why they can continue to grow wealth. (An asset will make you money, but a liability will take your money)

Let’s consider that all the following examples have loans on them (credit card counts), so we can see just a few more examples of debt.

Bad Debt

- Your home

- Your car

- Motorcycle

- Groceries

- Vacation

- Boat

- School

- Diner out

(I’m sure many of you want to disagree with some of these and that’s why I used them.)

Good Debt

- Apartment complex

- Your computer that’s used for your online store like Shopify or Amazon FBA

- Car dealership

- Your cell phone that runs your online business, like Kindle Publishing, or Blogging

- Self storage facility

- Money to lend out

- Rental home

- Basically, any loan for a business venture that produces more (after expenses) than the loan payment!

(I’m sure many of you want to disagree with some of these and that is why I used them also. 🙂 )

In the Bad Debt list, you may not like some of these choices, but remember, no matter whether you need these or not, doesn’t change the fact that they’re Bad Debt. The concept is very simple when deciding if something is Good Debt Vs Bad Debt. If the item on it’s own, (which you have a loan on) is not paying you more money than it’s own expenses, it is bad debt.

In the Good Debt list, there are also some grey area items that I put there on purpose for the point of discussion. The computer and cell phone are listed because it’s not just a tool for your business, but the business can’t run without them. So they’re a part of the business. So assuming the business is profitable, loans for those items are good debt.

The other item you might be questioning, is the money to lend out. Let’s say an investor finds a great rental property that cashflows a large return but he doesn’t have the funds to acquire it. You can borrow the money at a low rate (3.5%) and then loan it to the investor at a higher rate (9.5%) (where the investor still has positive cashflow).

That loan you made to the investor is Good Debt for you. The loan the investor received from you is Good Debt as well. Again, the rule is simple.

If what you bought with the loan you took out, makes you more money than the debt service, IT IS GOOD DEBT.

Can This Work For Me

If this rule is always in the back of your mind, you can evaluate the debt you are incurring. You’ll be less likely to take on bad debt if you don’t have good debt to pay for it. If you have Bad Debt that’s dragging you down currently, you now have a couple options, not just Dave Ramsey’s single answer.

- You can reduce your lifestyle and pay off the debt with your job. (Dave Ramsey)

- You can buy an asset with Good Debt that produces enough profit to pay off the Bad Debt for you.

- Or, you can do a combination of both.

Either way you need to keep this rule in mind from now on, and make the Good Debt overtake the Bad Debt. You can really accelerate your bad debt recovery by using good debt to acquire investments.

Once you get free from the pressure of your bad debt, you can really make very rapid advancement in your cashflow and equity positions. Really, the sky is the limit and your next goal should be to fire your boss.

Once you override your bad debt, your new investments using good debt can create enough extra cashflow to override your income from your job. When that happens, you own all your own time again, to use as you wish!

It’s Hard To Change

I personally understand how hard it is to change. A while back, I joined a network marketing company. The product line was based on Health and Nutrition for Weight Loss. Within two months I lost over 40 pounds. That doesn’t happen without being able to change! Changing eating habits is something that most Americans fail at. That is why nearly 3/4 of the adults in the U.S. are clinically overweight.

Don’t use averages to be your excuse. People who do great things, are not average. You landed here because you don’t want to be average. Right now, average is not a good place to be. Average is broke, overweight, and weighed down by Bad Debt.

The ONLY way to fix a problem is to make a change in the actions that caused it.

Please, make this a family issue. On this website, we encourage people to use “real life lessons” to teach your kids how to avoid and fix financial mistakes. Your job on this planet is to prepare your kids, so they have the opportunity to live the best life they can. Teach them based on what you learn. Involve them.

Depending on the issue, you may have to decide if they’re ready for the lesson. But, don’t underestimate your child too soon and have them miss out on an opportunity to learn and be a valued member of the family.

My son Brac is an author on this site and began offering his lessons at age 16. He has NO debt and has a really nice car, motorcycle, 4 wheeler, etc. Brac was given no money. He started with a used snowblower that didn’t run and he turned it into what he has today. You can read about his story here.

He had the ability to do this because of being included in on family financial strategy. Making something more out of something less, is exactly what creates wealth. You may want to have your kids follow my son. He would love to help.

Every Purchase From Now On

I would suggest not going overboard with this to the point that it frustrates you and you fall back to old destructive habits. You could start by changing the way you make your next mistake/purchase (lol).

Let’s say you and the wife want to buy a family boat next summer. While you’re shopping for the correct boat, you should both agree that there’ll be no purchase until you create a way to make the payments. Do not touch the income from your jobs. That money is off limits.

Create New Money

Remember to include your kids on this journey. This lesson is great at almost any age. You can create a fund for the boat. Depending on how long you have before next summer, you may try to create enough money in the fund to pay for the boat outright.

That would be ideal, because in my opinion, debt on toys is not the best idea when just getting started. But I know people, and some will do this anyway because they don’t have will power or the view of the bigger picture quite yet.

Most people have enough stuff that they don’t use or need, to sell off. That alone can pay for a big chunk of the purchase. You can also do the “buy low, sell high” strategy on craigslist, ebay, letgo, offerup, FB marketplace, etc.

You could also start a business on the side, doing a service for others, but either way use the creative minds of the whole family to decide. If your thinking is big enough, it may require using good debt to make it happen.

Ultimately you want to create assets (business, real estate, etc.) that make more money than they cost (positive cashflow). You should always have more cashflow from your assets coming in that expenses going out.

Sounds Like Work

It is work, but you’re doing it with your family and you’re all learning together. Personally, I think you should be thinking long term on your business ideas. You shouldn’t always be thinking of investment ideas that require a lot of your time to manage. Passive investments are better, because it your time is valuable.

An example of a more passive business would be a website. Once it’s built and running, it takes minimal maintenance. Your work is mostly front-loaded (it does take a lot of time a work up front).

Maybe you find a great deal on rental real estate, and once it’s all rented out with good tenants, you only work minimally (unless you get a bad tenant :-/ ). You could have a management company take care of the property for a fee and it will become a much more passive business.

Most likely, you’ll go into debt on the real estate. GREAT! That just makes this lesson better for everyone. You all learn that you can leverage other people’s money! You literally make money off other people’s money. It really is “all about the numbers”. Don’t buy a potential asset because you think it is neat, cool, or cute. Buy it because the numbers work. Do this right, and your good debt will pay for all your bad debt and more.