Do I need to register my business if it’s very small and just getting started? It may be an inexpensive form of insurance you need.

If you’re starting a business and want it to be professional, you’re going to have to know how to register a business with your local, state, or federal government. Actually if you plan to create a significant business (and why wouldn’t you?), you’ll have to register in one form or another with all of them.

Don’t let that get you too overwhelmed. We’ll give you some great information and resources to simplify things for you. However, before I start, you need to know that my decades of experience doesn’t make me an attorney. It makes me an entrepreneur, so you’ll need to verify any legal information.

There Is One Exception: But Don’t Do It

You don’t need to know how to register a business if you choose to be a sole proprietor and do business under your own name. I don’t recommend doing this because you’ll be using your personal social security number as your business tax identification. You would have to provide that number to your customers, suppliers, or possibly other entities upon request.

In the case of wanting to be a very small business, consider making yourself more professional with a business name. You can do this by registering a DBA (Doing Business AS). This is quite simple but can vary from state to state. So start by going to your county clerks office. Many times, that’s as far as you have to go. At least get a DBA.

Do Yourself A Favor

Choose a professional business name. What would give a better impression to a potential customer,

-

- “Carpet installation by Bob”

————————Or————————

-

- “Premier Carpet Service”?

You’ll want to take some time to think of a DBA name that is unique, yet tells people what service you provide. “The XYZ Company” doesn’t provide any information, so think on this and come up with a great name that people will remember and trust.

So now that you have your DBA in place. You can get your EIN (Employer Identification Number). This is your business’s tax id number and stops you from having to provide your personal social security number to people. Plus it’s FREE. I’ll explain more later in this article.

Now For The “Don’t Do It” Reason.

If you choose to go this “sole proprietor” route, you need to know that all your personal assets are NOT being protected! If your business gets sued, the lawsuit is actually against you personally, and everything you own is subject to loss. You also have the possibility of having a claim against your future earnings.

Even Worse!

Thinking of having a partner without using an entity? The classification of “General Partnership” puts you at a very high risk for loss of personal assets. Now it’s not just about you and your actions that could cause a lawsuit. It’s also your partner’s actions. It may not be some action that’s business related either.

For example: If your partner had a bad car accident and got sued, the business and everything to do with it, is at risk also! Your partner’s action could sink you financially! Don’t do this general partnership thing. Spend a couple bucks and select an entity that will shelter you from your business and your partner’s actions.

I Believe

Using entities such as LLC, S Corp, C Corp, etc., create a liability barrier between you personally and the operations of your business (some do this better than others). This is discussed more in detail in other articles on Profit Vs Wage.

Another great reason for using certain entity selections, is that there are great tax benefits to utilizing a great tax strategy plan designed by a great tax strategist/CPA. Research and find a proven good one, because there are far more bad ones that are not fully educated on all the options that can be used.

YES… You Have To Register

You need to know how to register a business if you want to protect your personal assets, and take advantage of fantastic tax benefits. Also, you want to be perceived in a professional manner by clients. It’s not that difficult, but many people remain nervous about this step in their business plan and opt to using an online service like ZenBusiness. They actually do much of the registering for free, so it’s certainly not expensive to use the service, but with a little patience and footwork, you can do this yourself.

Something Sad

As I have coached new entrepreneurs over the years, this has always been part of it. Knowing how to register a business is often met with a weird fear. “I am not joking on this”. People are worried about the legal cleanup when the business fails after they are registered with the government!

Really?!

Besides this weird fear, the simple facts of how to shut down a registered business do vary, but my experience is that it isn’t that difficult. Sometimes we set up a business entity for a project or short term business strategy. So there are instances where part of the business plan is to shut it down after the task has been completed. Many times it’s as simple as to just stop filing your annual report.

While you can pay a fee and file a form to shut it down, you can also just stop filing and paying your annual report. The government will send you notices if you don’t file, stating that you’ll lose your entity designation. Well, that’s what you want anyway, but it doesn’t cost anything and you don’t fill out any forms. (Again, I’m not an attorney, but guess where I got my information?)

Either way, don’t focus on fear. Focus on your business plan and keep tweaking it until every detail is covered and still shows the company as becoming profitable. You’ll be tweaking your business plan as you go anyway. You’ll see what parts work and what parts don’t. BUT, don’t do anything until you and your team (attorney, accountant, etc.) feel confident in the business plan.

How To Register A Business – Steps

Now that you understand that it’s safer and smarter to register your business as a separate entity, you need to decide which one to use. Obviously, you’re putting together a team since you’re building a business. You can’t be an expert in everything, so speak to your attorney and your tax adviser to figure out the best entity selection for your new business.

I have had S Corporations and LLC’s. For myself, it seems like the LLC has always been the best way to go. But every business is unique, as are the professionals giving advice. But now that you have decided on the proper entity to register, you need a business name. Something like “Premier Carpet Service LLC”, etc.

Name Availability

So after thinking and researching for days or even weeks, you’ve come up with a great name for your new entity. Now before you apply for registration, you need to see if your business name is actually available. If it’s already in use, you’ll need to use your plan B, C, or D, name choice until you find one that’s available. If you need to go back to thinking and researching, do that to get a great name. It does make a difference in perception by potential clients.

Here is a list (as of today) of the URL’s to research name availability per state. Now if you tried to get to the actual search functions listed in this chart yourself, It may be quite difficult. Many state websites are very tough to navigate. So I have done it for you. You’re welcome 🙂

It’s Fairly Easy

How to register a business, is not too difficult, but be sure you keep up with the proper paperwork once you do. Remember, your new entity is separate from you, so you need to keep great records. But first we have to create your new entity.

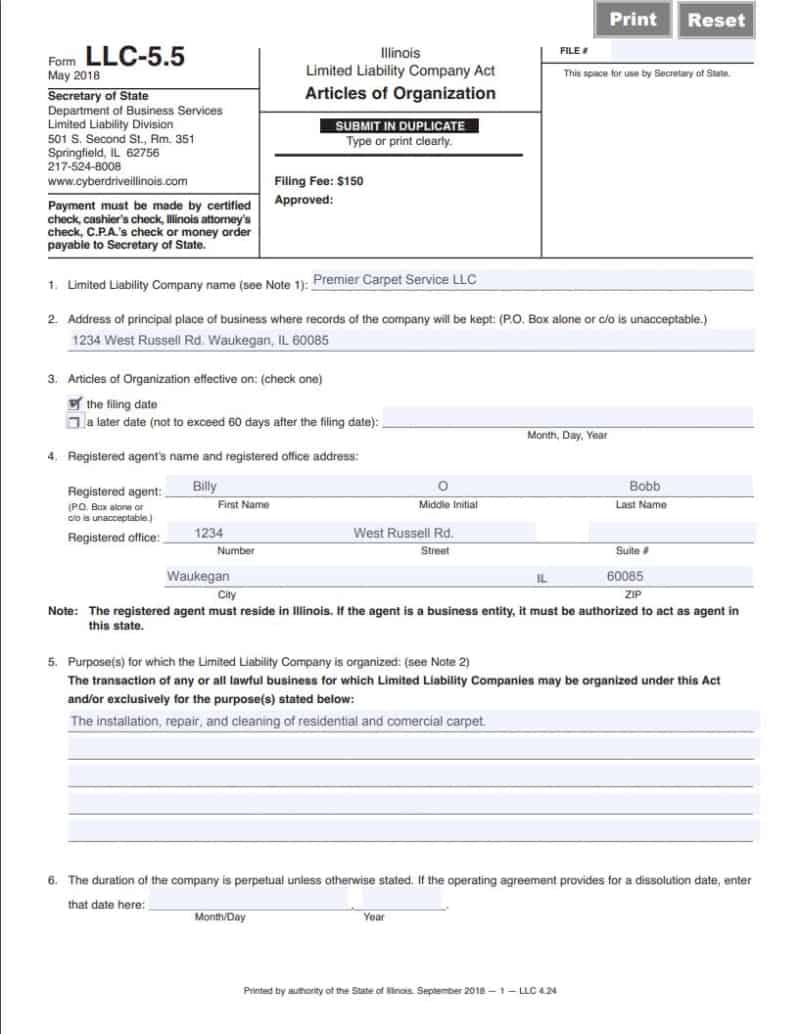

The formation of an LLC is going to be the right choice for most new businesses. So let’s see what it takes to make it happen. As an Example, let’s look at creating an LLC in Illinois. Illinois used to be one of the most expensive places to create an LLC, but have since reduced the cost of formation from $500 down to $150!

First Things First

The first thing you want to do is check to be sure your LLC’s name is available by using the above link for Illinois S.O.S. Name Search. Then you REALLY need to check if your business name is available as a domain so you can have a web presence in the future. Your business credibility really sinks without have a website.

Just go to BlueHost and check it’s available, because if it is, this is the best place to get your domain. Your domain is FREE with the purchase of hosting, which is like 3 or 4 bucks a month. This is a very inexpensive way to get a domain and hosting for the site that will drive business and show everyone everything your business can do for them, without you even having to pick up the phone.

It’s best if “YourBusinessName.com” is available. If it already exists, that would be confusing for your clients. Also, stick with the “.com”, as it’s more professional.

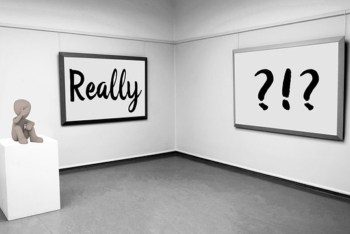

One Simple Form

Here is an example on how to fill out the online application for an Articles Of Organization for Illinois.

Now you can see how to register a business, as far as your Articles Of Organization for Illinois. It’s just not that difficult. You can see in this case that there’s just one Managing Member. The Registered Agent in this case is the same person as is the address. However if you’re creating an llc in a different state, you can hire a registered agent in that state to accept all your legal documents and they’ll be sure you stay up to date with filings.

If you researched your business name and it came out to be available, it’s likely that you will receive your approved Articles Of Organization in the mail soon.

Another Awesome Way To Register In IL

Just an FYI. In Illinois and some other states, you can file for a “Series LLC”. So to apply for your Articles Of Organization for a series llc, you use form LLC 5.5 (S).

So why would you want to have a series llc? This is beautiful! Yes the series llc will cost a little more ($400) upon organization, but it is SO worth it! Here is an example of the flexibility you have when you’re organized as a series llc:

- Take me for instance, having multiple real estate properties. I can create a series llc called “Cashflow LLC” as the parent llc. I can then create a separate llc in the series (called a sub-llc) for each individual property. That means that each property is protected from the others in the case of a lawsuit, but I only file taxes on “Cashflow LLC”. It’s the parent llc and all sub-llc’s flow through it for tax purposes.

After Organizing as a series llc for $400, each sub-llc only cost a $50 fee! I can have as many sub-llc’s as I want. Each sub-llc can be called whatever you want, because they operate under the “Parent’s Name”. Another great benefit is that when you want to create a new sub-llc, you just file form LLC-37.40 which is only 5 questions telling the Secretary Of State what the name of the sub-llc will be. In the example above, the sub may be named “Cashflow LLC – 4321 Easy Rd.”. Super simple and much easier and cost effective for having the protection of multiple LLCs.

Tax Step, On How To Register A Business

Again, your business is a whole separate entity from you personally. You will also use your EIN number for getting a bank account, hiring employees, getting loans, etc. You can get this immediately when you apply online at the IRS website. Here again this is only 5 simple questions, so do this immediately after receiving back your approved Articles Of Organization.

Bank Step, On How To Register A Business

You’ll need to get a checking account for your new business. I would suggest finding a free checking account at a local bank to start with. You’ll need your Articles Of Organization, your EIN, your personal drivers licence, and some money to put into the account. Of course you may want to check with the bank of your choice to be sure that’s all they need.

Don’t buy the bank’s expensive checks. There are TONs of cheap checks online. Just Google “Cheap Checks”.

Another financial item to check off the list is to get a company credit card. In most cases, since the business is new and hasn’t established credit yet, the card will also be tied to your personal social security number for collateral. However, this is a business credit card and ONLY for business related use! I’ll talk more on this later.

LLC Operating Agreement

There are several states the require an operating agreement, but you should create one whether you’re required to or not. An operating agreement is a document that describes how the business is to be run and how the responsibilities are assigned. Not only that but it also includes remedies for when a member or manager doesn’t fulfill their duties.

It Shows Things Like

- Who are the managers and members along with what portion of the company is owned by each.

- Who has authority to make certain decisions. It could be voted by just managers. It could be voted by each member based on percentage owned. Or perhaps there’s a single manager that makes all decisions in which the other members just have part ownership.

- Money in – It describes who put in how much and if there are further funds expected to be contributed. In the case of the company needing to raise more capital, all options/requirements are listed.

- Money out – It will describe how distributions are handled. Such as when the company is to provide distributions back to the members, or repayment of debt. It must all be listed here in the rules.

- Changes in membership – Everyone must know what happens if a member wants to sell, gets divorced, dies, gets sued, or faces bankruptcy.

- What happens in the case of the company needing to be dissolved? Perhaps a problem comes up, but it could also be a strategy move. Either way all members need to know how it will be handled.

- Each business is unique, so there may be other topics that need to be covered. You have the business plan so use it to think of all the possible subjects to be covered in the operating agreement.

Everyone Needs This

First off, you don’t know what the future holds. As your business takes off and you want or need to take on new members (to spread out the workload and risk, or to bring in new funding partners), you will need to provide your operating agreement so they know exactly what’s expected of them and other members.

If you’re to the point of needing funding, you will absolutely have to provide your operating agreement and your business plan. Your business plan should have been done in the very beginning before you even researched on how to register a business. You had to know you have a viable business, right?

Don’t skip this step

As you’re moving forward with your business, you will be reviewing your business plan and operating agreement on a regular basis. This is how you stay grounded. You follow your own, well researched instructions.

Never say never. These two documents are your road map, but if you see an alternate route along the way that’s more viable, you just change your course a bit and document it in these two documents. Just don’t loose focus on your WHY. Your WHY is the original reasons you took on this challenge in the first place. Stay on that path.

In most cases, the operating agreement is for member records and does not need to be filed. However, you should consider recording it at the county courthouse. If you bring on new members or make alterations to it for other reasons, provide copies to all members and record it again.

The Operating Agreement is a list of rules and remedies. If everyone involved is aware of them, nobody can argue how the business operates.

Wrapping Things Up

Just a few more things to consider here. I chose to give examples primarily on the LLC. That’s because it’s the easiest to manage from the standpoint of filings and taxes.

- An LLC can elect to be taxed as an S-Corp. This means that it’s a full pass-through company and does NOT pay federal taxes. The profits of the company flow through to the members based on percentage of ownership. This goes for losses as well. They also pass through to benefit the members on their personal tax filings. (There is no double taxation as there is with a C-Corp. Where the C-Corp pays federal taxes, and then all distributions go to the share holders and get taxed again.)

- There are no annual meetings required for LLC’s. You are also not required to register officers or record company minutes.

As mentioned above, you do NOT want to mix your personal funds with that of your business! If you want to maintain the benefit of protecting your personal assets, you need to here me. If you commingle funds between your business and personal lives, you leave yourself open to loss of your assets in the case of a lawsuit.

Keep Them Separate

If you do, and your business gets sued for any reason, you are at risk. All it takes is for a the plaintiff to have an attorney who does his homework (and they will). They’ll find any financial transactions where you commingled funds, and you’ll have your personal assets up for grabs!

You can personally provide structured loans to you business as long as you document them. However that will not work for using your personal funds to make a purchase for the business. You’ll have to write up a loan document signed by you personally and the managing member of the business. You’ll provide the funds by check and it will be deposited into the business account, all documented with receipts.

Do this correct, right from the beginning and never goof up with this one issue and you should be just fine. I know we covered a lot here, but you’ll do great whether you file everything yourself or use a service like ZenBusiness (which you really should check out). Remember, “if you fail to plan, you plan to fail”.